India’s GDP growth to be 6.5% in 2023-24; slashes forecast to 7% in current fiscal [details]

India is about to witness a baseline GDP growth of 6.5 p.c as per actual phrases in 2023-24, in accordance to the financial survey for 2022-23, which was laid in Parliament by Finance minister Nirmala Sitharaman on Tuesday.

The survey stated that in actual phrases, the economic system is predicted to develop at 7 p.c in the current monetary 12 months (2022-23), a downward revision from 2021-22, when the growth was 8.7 p.c in the earlier monetary 12 months (2021-22).

The fiscal deficit for 2022-23 is estimated to be 6.4 p.c of the GDP, the doc stated.

“Despite the three shocks of Covid-19, the Russian-Ukraine battle and the central banks throughout economies led by Federal Reserve responding with synchronised coverage fee hikes to curb inflation, main to appreciation of greenback and widening of the current account deficits (CAD) in internet importing economies, companies worldwide proceed to venture India because the fastest-growing main economic system at 6.5-7.0 per cent in 2022-23,” the survey famous.

According to the financial survey, India’s financial growth in 2022-23 has been primarily led by personal consumption and capital formation and these have helped generate employment as seen in the declining city unemployment fee and in the sooner internet registration in worker provident fund.

Moreover, the world’s second-largest vaccination drive involving greater than two billion doses additionally served to carry the patron sentiment which will delay the rebound in consumption. Still, personal capex quickly wants to take up the management position to put job creation on a quick observe, the survey stated additional.

The optimistic growth forecasts have been primarily projected on the premise of a number of constructive elements like rebound of personal consumption which gave a lift to manufacturing actions, larger capital expenditure, near-universal vaccination protection enabling folks to spend on contact-based providers, reminiscent of eating places, motels, procuring malls and cinemas, in addition to the return of migrant staff to cities to work in building websites main to a big decline in housing market stock.

The survey, which highlights the financial efficiency of key sectors throughout the ongoing fiscal, additional famous that strengthening of steadiness sheets of corporates, a well-capitalised public sector banks prepared to enhance the credit score provide and the credit score growth to the micro, small and medium enterprises (MSME), had been a number of the different elements which have boosted optimism for a wholesome growth projection in 2023-24.

Apart from housing, building exercise in common has considerably risen in 2022-23 because the much-enlarged capital funds (capex) of the Central authorities and its public sector enterprises is quickly being deployed, the survey stated, including that if one goes by capex multiplier, the financial output of the nation is about to enhance by not less than 4 occasions the quantity of capex.

“States, in combination, are additionally performing properly with their capex plans. Like the Central authorities, the states even have a bigger capital funds supported by the Centre’s grant-in-aid for capital works and an interest-free mortgage repayable over 50 years,” it famous.

Key highlights of Economic Survey:

Chief Economic Advisor V . Anantha Nageswaran has famous that India’s economic system is poised to do higher in the rest of this decade. Here are the important thing highlights from Chief Economic Advisor’s presentation on Economic Survey:

Recovery of the economic system is full; non-banking and company sectors now have wholesome steadiness sheets, therefore, we do not have to converse of pandemic restoration anymore, we now have to look forward to the following section.

Leverage ratio in the company sector went very sharply in the primary decade of millennium, the second decade was thus a payback time, extreme credit score growth had to be adjusted for in the second decade, steadiness sheets now have been repaired, & credit score growth is selecting up.

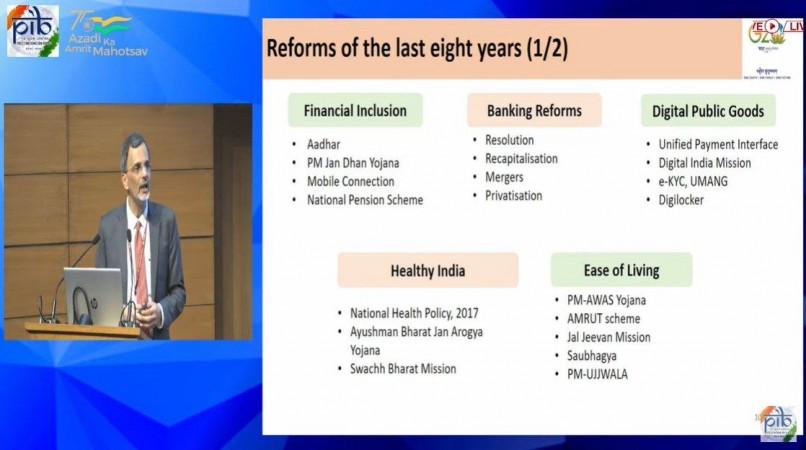

Reforms of final eight years spanning a number of dimensions together with digital, social and bodily infrastructure had been taking place at the same time as banking clear up was occurring.

(With company inputs)