SIDBI unveils “Prabhaav” – An Impact Study of the Fund of Funds for Startups

Hyderabad/ tenth February 2024: Fund of Funds for Startups (FFS), a key part of the Startup India Action Plan launched by Hon’ble Prime Minister Shri Narendra Modi ji in 2016, is as we speak one of the flagship programmes of DPIIT, Government of India and has confirmed to be a sport altering intervention of Government of India in nation’s Startup Ecosystem. The scheme is being managed by SIDBI on behalf of, and underneath the total steerage and course of DPIIT.

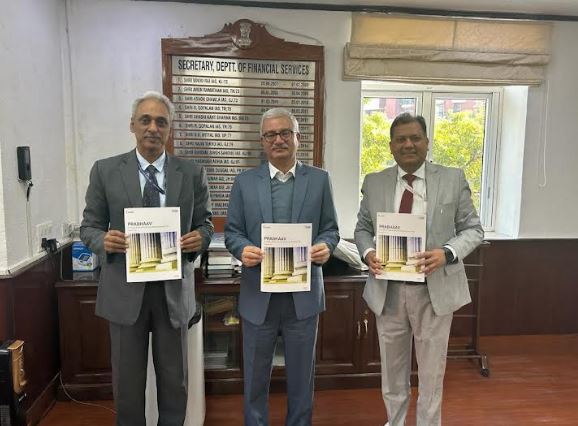

In this connection, a third-party evaluation of the scheme was undertaken by CRISIL, India’s premier analytics firm and pioneer of AIF benchmarking in the nation. CRISIL’s impression evaluation report viz. Prabhaav, was unveiled as we speak by SIDBI.

Shri S. Ramann, Chairman & Managing Director, SIDBI together with Shri S P Singh, CGM Venture Finance, offered the report back to Dr Vivek Joshi, Secretary, Dept. of Financial Services, Ministry of Finance, GoI, Shri Rajesh Kumar Singh, IAS, Secretary, DPIIT and Shri Sanjiv, IRS, Joint Secretary, DPIIT, Ministry of Commerce & Industry.

The Fund of Funds for Startups, which contributes to the corpus of class I & II Alterative Investment Funds (AIFs), with a mandate for funding to startups, is one of the key initiatives which has reworked India into the third largest startup ecosystem in the world as we speak, by offering a sizeable catalytic pool of danger & development capital to startups.

The report reveals heartening all-round outcomes of this initiative of GoI on elements encompassing multiplied move of capital, progressive options, inclusiveness & range in protection of startups, deepening of startup funding ecosystem in the hinterlands of the nation, strengthening of governance in addition to wealth creation.

Key highlights of the report point out that as on November 30, 2023, as many as 129 AIFs have been sanctioned dedication out of FFS throughout segments. The scheme has already catalysed investments to the tune of ~4x of the quantity drawn with ₹17,534 crore invested in 938 distinctive startups. Thus, the scheme resulted in important multiplier impact, selling enhanced capital move into this section. While FFS largely focusses on early-stage funding in younger firms, as many as 18 of its startups have already turn out to be unicorns.

The scheme has additionally channelised investments in startups in rising sectors reminiscent of deep tech, agri/agri options, well being tech, monetary providers, and sustainability. Implemented with emphasis on range & inclusiveness, after launch of FFS, 129 startups past Tier 1 cities have acquired investments aggregating ₹1,590 crore. Another heartening end result was the growing help to girls led startups in addition to girls led fund managers.

The scheme has ushered in a revolution in Venture Capital Space in India too, rising as hallmark of approval for the fund managers as properly. As per the survey performed by CRISIL as half of the evaluation, 89% respondents confirmed that help underneath FFS was instrumental in anchoring their fund elevate. More than 75% respondents mentioned they skilled a constructive impression in elevating non-institutional home capital submit dedication by SIDBI underneath the scheme. Further, out of the AIFs supported, as excessive as 35% are being managed by first time Fund Managers, which is able to assist deepen and improve the attain of the AIF / VC funding ecosystem, as summed up by CRISIL in its evaluation.

The Secretary, DFS and Secretary, DPIIT appreciated the initiatives and progress demonstrated by SIDBI in managing the scheme and the outcomes already achieved.

Since, its formation in 1990, when the danger capital and VC ecosystem for progressive enterprises and startups was practically non-existent in the nation, SIDBI has been impacting the lives of residents throughout numerous strata of the society by means of its built-in, progressive, and inclusive method. Over the final 3 many years, SIDBI has taken a number of pioneering steps to help increase of startup ecosystem together with help out of its personal steadiness sheet. SIDBI supported establishing of a number of schemes by itself earlier than rising as a key accomplice of the Government of India and several other State Governments for managing their imaginative and prescient in Startup area by means of Fund of Funds interventions. Apart from FFS, it additionally manages ASPIRE Fund of Funds of Ministry of MSME with give attention to Agro and Rural enterprises, and state focussed Fund of Funds for Uttar Pradesh & Odisha.

Sujata