The consequences of waiving EV road tax exemptions • EVreporter

Guest article by Meheli Roy Choudhury, Lead, Centre for Clean Mobility, OMI Foundation

The Electric Vehicles (EVs) ecosystem in India is rapidly expanding its market presence, driven by a combination of government incentives balancing demand-supply needs, infrastructure improvements, and growing environmental consciousness. One such critical measure aiding this growth has been the exemption of road tax for EVs, which has directly contributed to reducing the Total Cost of Ownership (TCO) for consumers. By eliminating this significant cost component, which can range between Rs.11,600 (Delhi for Ola Electric S1 Pro 2nd Gen) to Rs.8,725 (Gujarat for Ola Electric S1 Pro 2nd Gen) per EV (varies as per state and vehicle category), this waiver has helped lower the higher initial price of EVs which stands as one of the biggest roadblocks towards consumer acceptance of the offering. However, the decision to waive these exemptions poses important implications for the future of EV adoption in India. Without these exemptions, the price gap between EVs and ICE vehicles widens, potentially slowing the adoption rate.

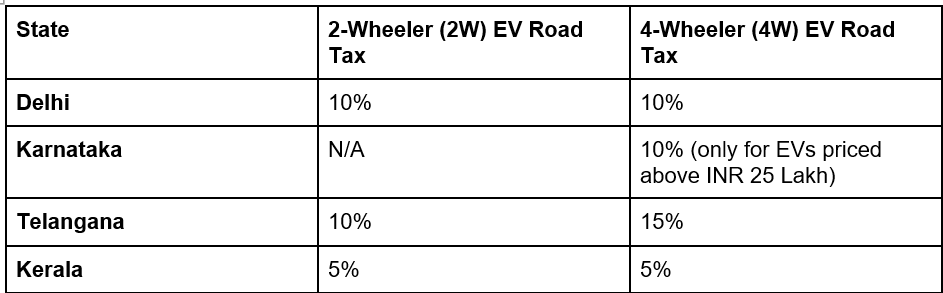

By waiving the road tax exemption on 4Ws, 3Ws, and 2Ws, the cost burden on consumers increases, directly impacting the affordability of EVs and tipping off the balance, which helps make EVs cost-competitive. Table 1 shows the EV road tax levied on 2Ws and 4Ws separately for these states that have rolled back the benefits, highlighting price differences.

Table 1: State-wise depiction of road tax levied on EVs. Source: Author’s analysis based on PIB updates

Andhra Pradesh’s EV policy elapsed in July 2023 (applicable for 5 years from June 2018), which automatically made road tax for EVs mandatory. This was exempted again in October 2024, a full 15 months later. As per data from the Vahan Dashboard for Andhra Pradesh, we can notice the drop when comparing EV registrations in H1 (20,231) to H2 (12,619), marking a 37.63% decrease. This remarkable fall can be attributed to the re-introduction of the tax in the market, which hurts consumer confidence due to the impact on affordability, keeping in mind the festive season is a huge pull for automobile sales, which faltered expectations in this regard and failed to pull in a larger consumer base for EVs. In contrast, states like Maharashtra (55,899) and Uttar Pradesh (97,331), which continue to offer 100% road tax exemptions, are experiencing growth in EV registrations in the Q3 FY 2024-25. Compared to Q2, registrations increased in Maharashtra by ~24.56% and by ~ 23.91% in Uttar Pradesh.

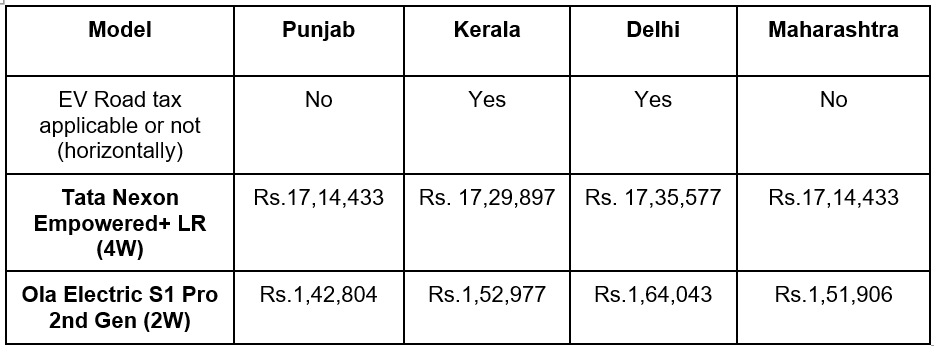

In Table 2, there is a comparison of states that have waived the exemption vis-a-vis states that continue offering it, along with different models of 4W and 2W to understand how the price of an EV varies across the country with the application of the road tax.

Table 2: Comparison of prices of different EV models across different states in India. Source: Author’s analysis based on CarWale and Ola App, as of 1st October 2024

Herein, it can be noted that comparing the price of Tata Nexon EV’s top-selling model in Punjab, where a full road tax exemption exists, to states like New Delhi, where the exemption has been revoked, shows a marked difference in final costs. In Punjab, the model may cost approximately Rs.17.14 L, while in Delhi, the same vehicle’s on-road price could surge to Rs.17.3 L after adding the tax, insurance and other charges, making it less attractive for consumers. Comparing Punjab and Kerala, there is a difference of Rs.15,464. Likewise for a 2W segment, taking the Ola electric S1 Model as an example, Punjab has the lowest price among the four states and New Delhi again faring a substantial price.

Consequences of policy shifts

This underscores the stark price disparity in EVs caused by a policy change, which significantly affects consumer willingness to pay. At this stage, the market needs incentives to build consumer confidence, encourage manufacturers to scale production and lower future costs. Removing these could negatively impact consumer interest, investment in R&D, and the long-term sustainability of India’s EV market.

The potential revenue loss from road tax exemptions for EVs could be a reason for states to reconsider their policy. However, this view overlooks the long-term benefits of higher EV adoption, such as job creation, a green economy, and lower healthcare costs due to reduced pollution. Increased EV sales also generate indirect revenue from GST and electricity consumption. Interestingly, Delhi’s EV cell addresses revenue loss through a non-lapsable fund sourced from ICE vehicle cesses like the Air Ambience Fund and Pollution Cess, demonstrating innovative solutions to support EV adoption.

Global practices

Several countries have used road tax waivers to boost EV adoption, making them more affordable and accelerating sales. Norway, a leader in EV transition, exempted road taxes for 25 years, reaching 82% EV market share in 2023 and 94.3% of new registrations in August 2024. In 2023, The Netherlands (43% EV sales), France (25%), and Sweden (40-50%) have followed suit, using tax waivers & incentives to lower EV TCO. While the impact is evident, the direct correlation between road tax waivers and EV adoption needs to be quantitatively studied across geographies.

Driving Forward

EV adoption is steadily growing in India, with a 13.16% rise in EV registrations in the first half of 2024 compared to 2023, with 9,50,655 EVs registered in 2024 as of October 29, 2024. It becomes prudent to sustain this ecosystem for all stakeholders. Herein, we see how retaining road tax waivers is essential to maintaining affordability and fostering adoption. The cost differential created by such waivers often serves as the tipping point for potential buyers. As states aim to meet their electrification goals and lower tailpipe emissions, they must consider the broader implications of their fiscal nudges in the EV policy. Instead of revoking road tax exemptions, state governments should advocate for a 100% waiver of road tax for EVs, recognising the long-term benefits. By maintaining these financial incentives, states can ensure that EVs remain within the reach of consumers, ultimately contributing to meeting the ambitious target of EV30@30 and fostering a sustainable future for India’s transport sector.

Also read: How taxation on premium ICE cars could drive EV adoption in India

Subscribe & Stay Informed

Subscribe today for free and stay on top of latest developments in EV domain.