Earn Up to 7.95% As PNB Housing Finance Raises AA-Rated Fixed Deposit Rates

PNB Housing Finance Ltd is certainly one of India’s prime housing finance firms. It just lately revised its rates of interest of lower than ₹5 Crores on FDs. After this revision, it gives rates of interest starting from 7.35% p.a. To 7.95% p.a. on deposits that mature in 12-120 months. The PNB Housing Finance FD interest rates are efficient from seventeenth February 2023.

For deposits up to ₹1 Crore, senior residents can get pleasure from a further 0.25% p.a. curiosity over the bottom fee. They additionally offer you the choice of month-to-month, quarterly, half-yearly and annual payout, permitting you to have a gradual stream of revenue not tied to the market. The NBFC has a AA/Stable score by CARE and CRISIL.

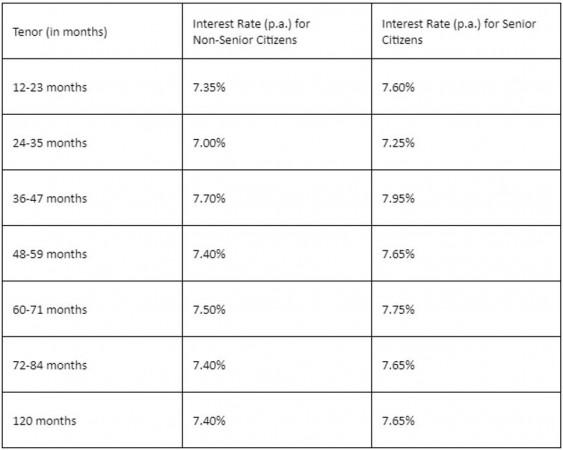

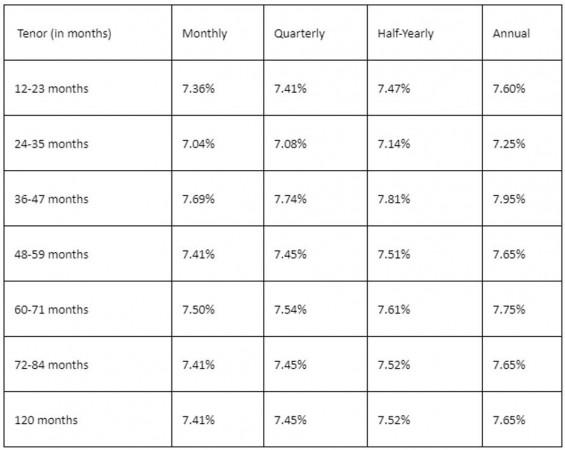

The revised rates of interest of PNB Housing Finance Ltd are as follows:

PNB Housing Finance FD Interest Rates of Cumulative Fixed Deposits for General and Senior Citizens

PNB Housing Finance FD Interest Rates of Non-cumulative Fixed Deposits for General Citizens

PNB Housing Finance FD Interest Rates of Non-Cumulative Fixed Deposits for Elderly Citizens

Why Do You Need to Consider the PNB Housing FD?

PNB Housing supplies dependable financial savings choices for people in addition to firms with the PNB Housing Finance Fixed Deposits. The advantages of the PNB Housing Finance FD are:

- Lucrative returns: They supply aggressive rates of interest together with a gradual curiosity circulate. You can simply begin a PNB HFL mounted deposit to handle and plan your bills. It may also help you construct wealth and develop your retirement corpus. You can use FD calculators accessible on-line to discover the curiosity revenue.

- Guaranteed returns: The assured returns you get make it among the finest financial savings choices out there. Market fluctuations don’t affect the returns that you simply get. Therefore, you get assured returns in your PNB HFL mounted deposit.

- No tax deduction: No TDS is deducted if the curiosity revenue is lower than ₹5,000 each monetary yr.

- Premature closure: Premature closure of PNB HFL mounted deposits is allowed after the three-month lock-in interval. Any untimely withdrawals made inside six months are charged an rate of interest of 4% per yr.

- Flexible tenor: Individuals can open a PNB Housing FD for tenors of 12-120 months. You can choose a tenor that most closely fits your wants and necessities. Consider the issue of liquidity earlier than you choose a tenor.

- Loan towards mounted deposit: You can get a mortgage towards your PNB HFL for up to 75% of the deposit quantity. This will enable you to fund any monetary difficulties.

Eligibility Criteria for PNB Housing Finance Ltd FD

The entities talked about beneath are eligible to open a PNB Housing Finance Limited Fixed deposit account:

- Indian Citizen

- Sole Proprietorship

- Hindu Undivided Family (HUFs)

- Family trusts

- Companies, together with group corporations

- Minors underneath lawful/pure guardianship

- Religious and charitable trusts

- Co-operative societies

- Association of Persons

With 100+ branches unfold throughout 35 cities in India, their huge community supplies doorstep companies for his or her FD account holders. The minimal quantity for month-to-month revenue schemes of PNB Housing Ltd is ₹25,000. For all the opposite plans, the minimal deposit is ₹10,000. You can open a joint FD account with three joint holders most. The contribution for a similar will be made by means of cheque, cheque administration system. Make positive to use the FD calculator to get an concept in regards to the returns you’re going to get once you get began with a PNB housing mounted deposit.