Nepal and India are set to sign an settlement for cross-border digital payments utilizing e-wallet, which is anticipated to enhance commerce and tourism by eliminating foreign money hassles.

The deal is anticipated to be signed throughout Prime Minister Pushpa Kamal Dahal’s go to to India someday this month, in accordance to Nepali media studies.

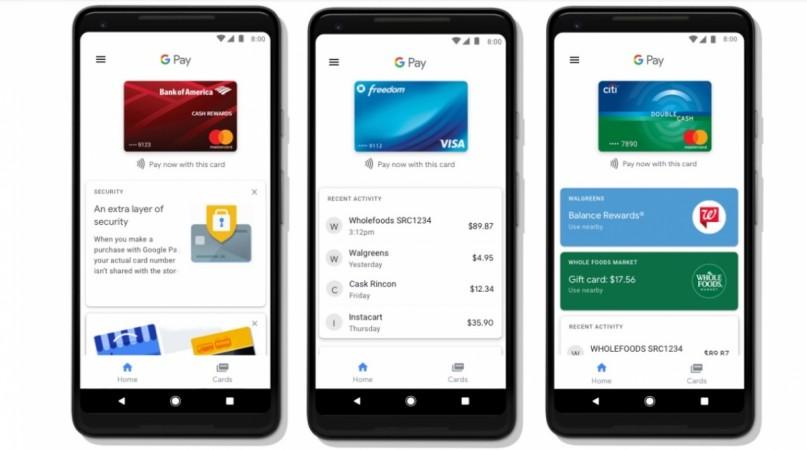

The accord will enable Indian vacationers in Nepal to make digital payments utilizing Indian e-wallets like BharatPe, PhonePe, Google Pay and Paytm.

![[Representational image] Transaction](https://data1.ibtimes.co.in/en/full/634581/transaction.jpg?h=450&l=50&t=40)

According to the studies, the 2 neighbours have chalked out an settlement for this goal, and the doc is awaiting signatures from each international locations’ officers.

New Delhi’s Ambassador to Kathmandu, Naveen Srivastava stated at a latest programme that the proposed Indian digital cost service in Nepal would enhance its journey and tourism business.

An overland Indian guests’ survey performed earlier than the Covid-19 pandemic confirmed that the typical size of keep of Indian vacationers coming overland was 5.8 days. The common expenditure per customer was Rs 11,310.

Advantage of journey to Nepal

According to Indian media studies, the benefit of travelling to Nepal is that one didn’t want to change cash.

Tourism entrepreneurs say that the launch of digital cost providers will eradicate the trouble of carrying giant quantities of money for Indian vacationers and businessmen in Nepal.

Last May, cost system operator Gateway Payment Service started a cross-border cost system for the primary time in Nepal based mostly on inter-operable and mobile-first know-how.

Interface being deployed

The National Payment Corporation of India and its worldwide arm International Payments had joined fingers with Gateway Payment Service and Manam Infotech to deploy a unified cost interface in Nepal.

The system will allow payments for bigger digital items and enhance inter-operable real-time person-to-person (P2P) and service provider cost transactions (P2M) in Nepal.

The unified cost interface is a real-time cost system that gives person-to-person and person-to-merchant transactions merely, safely and securely in India.

The system is presently not on a reciprocal foundation, and Nepalis usually are not allowed to make payments by means of Bharat-QR whereas travelling to India.

Recently, Nepal Rastra Bank Governor Maha Prasad Adhikari underscored the necessity for larger collaboration on fintech between India and Nepal to start a cross-border and QR cost methods for mutual profit.

“We anticipate a collaboration between the Nepali and Indian non-public fintech firms by sharing of the infrastructure and mitigating cyber-related dangers, which may gain advantage each international locations,” he stated.

Nepal central financial institution optimistic

Nepal’s central financial institution is optimistic about facilitating in addition to enabling roles within the India-Nepal e-commerce and monetary know-how sector, the central financial institution stated.

Though India is an in depth neighbour of Nepal, monetary transactions between the 2 international locations are sophisticated.

In January, the federal government opened the door to international traders to take part in Nepal’s digital cost system beneath a newly amended coverage.

(With inputs from IANS)