A Market Outlook Post-Thanksgiving

Thanksgiving in the U.S. is more than just any Thursday in November — it’s a major holiday. On the fourth Thursday of the month, Americans come together to celebrate Thanksgiving, a tradition that dates back to 1621, when the Pilgrims aboard the Mayflower held a feast to give thanks for a successful harvest. This year, the financial markets appear to reflect a similar sentiment of gratitude, with U.S. equities closing near record highs and delivering annual returns exceeding 20%.

As Thanksgiving fades and year-end festivities approach, now is an opportune time to evaluate the current market landscape.

A New Treasury Secretary and Market Optimism

Scott Bessent, a hedge fund manager and former partner at Soros Fund Management (1991–2015), has been appointed Secretary of the Treasury by President-elect Donald Trump. Markets have viewed this nomination as a stabilizing factor amidst concerns about the administration’s proposed tariffs and restrictive trade policies. While the long-term impact of this choice remains to be seen, investor sentiment has been broadly positive, reflecting cautious optimism for the time being.

Seasonality in Equities: December Insights

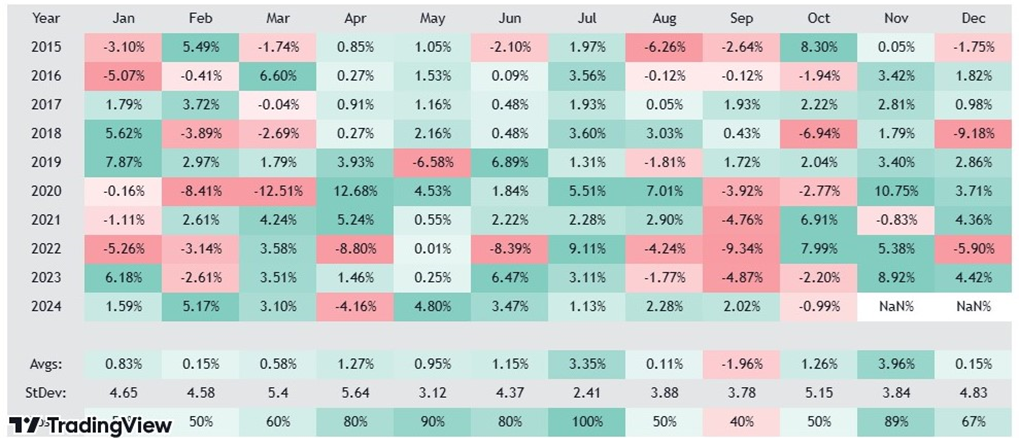

The final months of the year are marked by notable seasonality in stock markets, commonly associated with commodities but equally applicable here. The S&P 500 is on track to close another stellar year, achieving back-to-back annual returns of over 20% — a feat last seen in the early 1990s.

Historically, whenever the S&P 500 delivers such strong returns by December, the final month of the year often contributes an additional 1% to annual gains. However, years of record-breaking performance may slightly dampen the scale of December’s rally.

Broader historical data paints a more optimistic picture. Since 1950, U.S. equity markets have posted positive returns 80% of the time from the Tuesday after Thanksgiving through the second trading session of the new year, averaging a 2.6% gain. The Russell 2000 has performed even better since its inception in 1979, with average gains of 3.3% during this period. Notably, technical indicators like the VWAP suggest that current market levels are well-supported, reflecting strong underlying demand and providing a reference point for the potential continuation of the rally.

Implications and Risks

What does this mean for investors? While the strong year-end seasonal patterns are encouraging, they must be considered alongside elevated market valuations, as indicated by metrics like price-to-earnings ratios. Recent trends, including a rotation from high-growth tech stocks to low-beta, low-volatility equities, suggest growing investor caution—a sentiment that sometimes precedes market corrections.

Looking ahead, two key events could add volatility to markets. November’s inflation report is set for release on December 11, followed by the Federal Reserve’s interest rate decision during the December 18 FOMC meeting. Both could significantly influence market sentiment and trajectory.

Closing Thoughts: Balancing Gratitude with Prudence

As the year winds down, it’s important to strike a balance between optimism and caution. This has been an extraordinary year for equities, and such exceptional performance is unlikely to repeat soon. Just as Thanksgiving reminds us to be grateful, investors should appreciate this year’s successes while remaining mindful of risks.

Neel Achary