The 17th Asian Financial Forum concludes successfully

HONG KONG, Jan 26, 2024 – The 17th Asian Financial Forum (AFF), collectively organised by the Hong Kong Special Administrative Region (HKSAR) Government and Hong Kong Trade Development Council (HKTDC), successfully concluded right now, attracting over 3,600 monetary and enterprise elites from greater than 50 nations and areas, together with over 70 abroad and Mainland China delegations. The Forum showcased Hong Kong’s thriving economic system as contributors explored alternatives, accelerated sustainable improvement and multilateral cooperation, and launched Hong Kong’s conferences for the 12 months.

The occasion was marked by a vibrant environment. Various segments had been properly attended, together with the opening session, plenary discussions, coverage dialogue, keynote luncheons, and cocktail reception. Leaders from all over the world actively engaged in discussions.

In simply two days, the Forum organized over 700 one-on-one conferences, successfully connecting traders with mission homeowners and exploring alternatives for trade and funding cooperation. After the Forum’s conclusion, contributors can have the chance to proceed discussions and conferences on-line from tomorrow till 30 January (Tuesday).

Over the two-day bodily occasion, the AFF introduced collectively greater than 140 policymakers, worldwide monetary and multilateral organisation representatives, monetary establishments and company leaders from all over the world as audio system.

On the primary day of the Forum, Prof Jeffrey D Sachs, President of the UN Sustainable Development Solutions Network, addressed the keynote luncheon, affirming the significance of Hong Kong as a world monetary centre. He mentioned that international cooperation might assist remedy issues that had been even past our attain. He believed Hong Kong might play a full function in sustainable improvement financing, an more and more essential space.

One of the highlights of this 12 months’s AFF was the Plenary Session I – Charting the Path to a Shared Future, hosted by Christopher Hui, Secretary for Financial Services and the Treasury of the HKSAR, bringing collectively monetary officers from all over the world to debate financial challenges nations face. Julapun Amornvivat, Deputy Minister of Finance, Thailand, mentioned: “The Asian Financial Forum is the place the place each the private and non-private sectors can have sincere discussions to seek out options to deal with main issues right now and remodel the economic system for the longer term.” H.E. Dr Mohamed Maait, Minister of Finance, Egypt, talked about that the world was grappling with rising geopolitical tensions and an absence of readability in regards to the future, weighing on the achievement of sustainable financial progress. To deal with international challenges, the world wanted to deploy all efforts to coordinate financial insurance policies on a multilateral scale.

On the second day, the Breakfast Panel targeted on Unleashing the Dragon’s Currency: Navigating Renminbi Internationalisation on the Global Stage, permitting contributors to delve into the renminbi’s rising use worldwide and tendencies in worldwide demand. Prof Douglas W Diamond, Nobel Laureate in Economic Sciences in 2022 and Merton H Miller Distinguished Service Professor of Finance on the University of Chicago’s Booth School of Business, addressed the Keynote Luncheon on the second day, which was moderated by Raymund Chao, Asia Pacific and China Chairman, PwC.

Global Spectrum, Dialogues for Tomorrow and Fireside Chat introduced collectively pioneers from varied industries to debate a number of topical topics, explored the most recent Web 3.0 and digital asset improvement, the way forward for fintech innovation, CIO Insights, inexperienced finance and alternatives in new markets. Speakers included Bob Prince, Co-Chief Investment Officer of Bridgewater Associates, Dr Ma Jun, Chairman and President, Hong Kong Green Finance Association (HKGFA), Guinandra (Andra) Jatikusumo, Group Director and Chief of Investments & Business Development of CT Corp, Darmawan Junaidi, President Director, Bank Mandiri, Yat Siu, Co-Founder and Executive Chairman, Animoca Brands, and extra.

Understanding prospects for mainland industries, environmental economics

To gauge contributors’ views on the worldwide financial outlook this 12 months, the Forum carried out on-site voting throughout panel discussions. For occasion, on the Panel Discussion on Global Economic Outlook, contributors had been requested in regards to the biggest threats or uncertainties to financial progress within the Asia-Pacific. Most attendees recognized geopolitical fragmentation (66.7%) as the largest problem, adopted by a slowdown within the restoration momentum in key economies (17.7%), persistent inflation (6%), a tightened financial atmosphere (4.2%), continued provide chain reshaping (3.6%) and different components (1.8%).

In the newly launched Panel Discussion on Stewarding China’s New Chapter, contributors had been requested about essentially the most promising industries in Mainland China. The digital economic system took prime spot with 31.4%. Electric autos (26.1%) and renewable vitality (18.8%) adopted in second and third place, respectively. Advanced manufacturing (15.8%), different industries (4.2%) and digital gadgets (3.2%) ranked subsequently.

Over 700 matching periods held on-site, on-line platform continues to yield outcomes

Through the years, the Forum has performed a vital function in deepening enterprise and commerce collaboration. AFF Deal-making, a world funding project-matching occasion collectively organised by the HKTDC and Hong Kong Venture Capital and Private Equity Association (HKVCA), was properly acquired, facilitating over 700 one-on-one conferences, connecting funds and funding tasks from all over the world. The founding father of one of many start-ups from Thailand mentioned he had met 20 guests with potential offers, starting from a household workplace to a authorized adviser. He additionally commented that the geographical range of the guests at Deal-making was in depth, starting from India to Europe and Japan. The deal-making session had offered helpful alternatives to seek out potential enterprise companions.

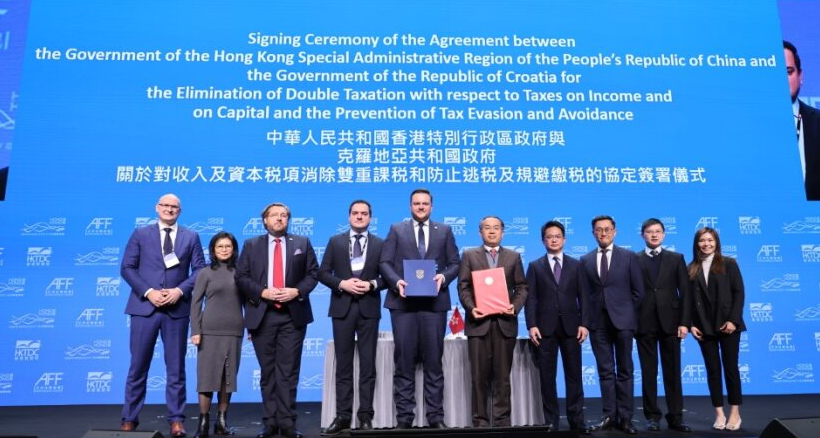

This 12 months’s AFF additionally facilitated the signing of assorted Memorandums of Understanding (MoUs) and Agreement. These included the Comprehensive Avoidance of Double Taxation Agreement between Hong Kong and Croatia and Memorandum of Understanding between the Financial Services Development Council and Financial Sector Development Program of Saudi Arabia.

The Forum additionally featured exhibition zones together with the Fintech Showcase, Fintech HK Startup Salon, the InnoVenture Salon and Global Investment Zone, presenting revolutionary options from worldwide monetary establishments and introducing potential unicorns from Hong Kong and all over the world. The exhibition section introduced collectively over 140 exhibitors, together with worldwide monetary establishments, know-how firms, start-ups, funding promotion businesses, and sponsors, together with data companion PwC, together with HSBC, Bank of China, Standard Chartered Bank, UBS, China International Capital Corporation (CICC), Huatai International and Cyberport.

The 2024 International Financial Week (IFW) commenced on 24 January to create synergies, bringing collectively over 20 companion occasions. These occasions cowl many subjects of world curiosity to the monetary and enterprise group. They embody personal fairness funding, various investments, sustainable investments, household workplaces and girls’s empowerment, amongst others. These occasions spotlight the function of Hong Kong as a world monetary centre.

To seize alternatives and promote the convention and occasion economic system, the AFF collaborated with varied organisations to rearrange actions for contributors past the Forum. These actions included free admission to the Hong Kong Palace Museum, Hong Kong’s iconic Aqua Luna red-sail junk boat, TramOramic tour and open-top Big Bus organized by the Hong Kong Tourism Board. These experiences allowed discussion board visitors to really feel at house and recognize the vibrancy and variety of Hong Kong.

Furthermore, to supply abroad contributors with a greater understanding of the Guangdong-Hong Kong-Macao Greater Bay Area and the huge enterprise alternatives inside, organisers will lead a delegation to Shenzhen tomorrow (26 January), together with company visits and alternate actions.

Neel Achary