Several new-age stocks have witnessed sharp selling in the first half of January, as the stock market goes through correction amid global uncertainties.

This list includes stocks of new-age companies like FirstCry and MobiKwik which fell more than 20 per cent.

Mother and childcare e-commerce platform FirstCry’s stock has fallen by 24.82 per cent since the beginning of this year to date. Currently, the stock is trading at Rs 489.

Fintech major MobiKwik’s share price fell by 23.07 per cent to Rs 456. MobiKwik was listed in December 2024. After listing, the stock saw a big rally. Currently, it is trading at Rs 698.30 per share.

Insurance distribution provider PB Fintech’s stock has fallen 18.71 per cent between January 1 and January 17 and is trading at Rs 1724.

Le Travenues Technology Ltd, which owns online travel aggregator Ixigo, saw its stock decline by 20.63 per cent to Rs 142 so far this month.

Food delivery and quick commerce service providers Zomato and Swiggy’s stock declined by 10.38 per cent and 12.75 per cent, respectively, to Rs 247 and Rs 473 apiece.

Apart from this, the stock of new-age insurance company Go Digit General Insurance has fallen by 11.76 per cent to Rs 288 since the beginning of January.

The stock of the leading fintech company Paytm also fell more than 9 per cent since the beginning of January and is currently trading at Rs 897 apiece.

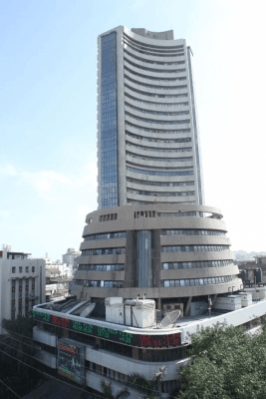

The market has also seen a decline since the beginning of January. During this period, the Sensex fell by 2.42 per cent and the Nifty by 2.30 per cent.

According to market experts, the reason for the decline is global instability due to tariff threats by US President-elect Donald Trump, the high valuation of the Indian stock market, and the third quarter results of FY 2024-25 are expected to be weak.

(With inbputs from IANS)