budget in 2020

Finance Minister Nirmala Sitharaman offered her second budget on 1 February. The market noticed a decline for the second time in a row. Nifty closed down 2.5%

न्यूज डेस्क, अमर उजाला, नई दिल्ली

Finance Minister Nirmala Sitharaman offered her second budget on 1 February. The market noticed a decline for the second time in a row. Nifty closed down 2.5%

न्यूज डेस्क, अमर उजाला, नई दिल्ली

Internet Desk. If you’ve got any work associated to the financial institution in the month of February, then it’s best to end your work now with out dropping any time. In such a scenario, it’s best to complete all of the work associated to your financial institution at once. Otherwise you will have to fret. The motive for this is that about 10 days vacation is going to return in the banks in February.

In such a scenario, if it’s important to complete any vital work in the financial institution in the month of February, then undoubtedly verify the vacation checklist for this complete month. In this checklist, you will have a complete of 10 financial institution holidays in completely different states in this entire month.

Before going to the financial institution, it’s important to see the checklist of financial institution holidays as soon as, due to that it will be the explanation. This is since you go to the financial institution and then you come to know that there is a vacation in the financial institution, then you will be upset.

Samachar Jagat

Internet Desk. You will even be troubled by power cuts and electrical energy payments at residence. Many occasions there’s a power lower in your home or close by for hours and hours resulting from which you have to fret. Also the payments must be paid. In such a state of affairs, a small generator has come available in the market for you, which will run with out petrol and diesel and can also be low-cost and you will additionally get it on-line.

This is a conveyable photo voltaic power generator. Which simply recharges within the solar and you can use it comfortably. You do not even must go to the market to buy it. You can simply get it on-line as effectively. Its weight is only one.89 kg.

Its market worth is round Rs 16,000, you may buy it from the web web site Amazon. For this you must spend money as soon as available in the market. No have to spend money many times for this.

Samachar Jagat

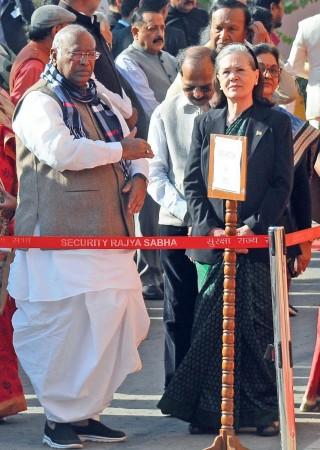

Congress Parliamentary get together chairperson Sonia Gandhi will attend the President’s tackle to Parliament on Tuesday as many get together MPs, together with Leader of Opposition in Rajya Sabha Mallikarjun Kharge, are caught in Srinagar due to inclement climate, sources stated right here.

Jairam Ramesh tweeted, “Due to delayed flights from Srinagar airport on account of inclement climate circumstances, Leader of Opposition in the Rajya Sabha, @kharge ji & many different Congress MPs can be unable to attend the President’s tackle to each Houses of Parliament at 11am as we speak.’

President Droupadi Murmu will tackle the joint sitting of Parliament for the primary time after being elected to the submit. She will outlay the federal government’s imaginative and prescient for the present 12 months.

The Parliament Budget session will begin from Tuesday. Finance Minister Nirmala Sitharaman will desk the Economic survey. She will current the Union funds on Wednesday.

Rahul, Priyanka go to Mata Kheer Bhawani temple

Congress leaders Rahul Gandhi and Priyanka Gandhi on Tuesday paid obeisance on the Mata Kheer Bhawani temple in Jammu & Kashmir’s Ganderbal district.

The siblings arrived in Tullamulla city of Ganderbal district early this morning to a heat welcome by the individuals.

According to get together sources, they prayed for peace and brotherhood in the nation. Mata Kheer Bhawani temple is the holiest spiritual place of the Kashmiri Pandit group.

Despite their mass exodus from the Valley, scores of migrant Pandits come every year to attend the annual competition on the temple.

(With inputs from IANS)

Domestic benchmark indices opened with marginal good points on Tuesday after ending Monday’s extremely risky buying and selling session in inexperienced. On the home entrance, the market contributors will take cues from the financial survey 2023-24 and Union Budget. On the worldwide entrance, the worldwide monetary market will react to the outcome of the fed’s policy assembly.

The BSE Sensex opened 270 factors larger at 59,770 factors, whereas Nifty opened 80 factors larger at 17,731 factors from the earlier shut and Nifty Bank opened above the 40,500 mark.

As of 1:15 PM, Sensex is buying and selling down merely 16 factors or 0.02% to 59,484 factors, whereas Nifty is buying and selling flat at 17,647 factors and Nifty Bank is buying and selling up 300 factors or 0.75% to 40,688 factors.

So far within the buying and selling session, Sensex and Nifty have swung between good points and losses as investors grapple with excessive volatility amid the uncertainty of the near-term outlook.

Commenting in the marketplace outlook, Dr. V Okay Vijayakumar, Chief Investment Strategist at Geojit Financial Services, mentioned, “The Budget tomorrow and the Fed resolution on rates of interest by night tomorrow may have a huge impact on markets. A constructive, as we go into the Budget, is that as an alternative of the standard pre-Budget rally on expectations, this time, we had a market correction triggered by the Adani disaster. So, if there aren’t any detrimental surprises within the Budget and the Fed commentary just isn’t hawkish, there could be a post-Budget rally out there.”

Wall Street closed decrease on Monday as investors braced for the fed’s policy announcement and incomes report from main companies. The Dow declined 260 factors or 0.77%, whereas S&P 500 misplaced 53 factors or 1.3% and Nasdaq closed 227 factors or almost 2% decrease on Monday.

The market is pricing in 25 foundation factors (0.25) price hike by the fed as inflation exhibits indicators of easing. Yet, the seemingly course of the market within the near-term may even be formed by what fed thinks about inflation and employment within the US.

Quote on behalf of Mr. Ankur Shrivastava (Founder & Managing Partner, Momentum Capital):-

“We hope that the federal government will think about exempting FDI in unlisted firms from capital features taxes. Currently, the LTCG tax fee on holdings over 24 months is 10% with out indexation on FDI. Abolishing this tax like many developed international locations have carried out, like US & Singapore, would spur additional FDI inflows into the nation and assist help financial system builders on the earliest levels.

In addition, we hope the ESOP regime is made extra pleasant for early staff & tax timing is rationalized. The present revenue tax outlay required when the workers train the ESOPs make them unattractive & unaffordable for expertise. Delaying the tax ask to when the sale occasion takes place would allow many extra staff to learn monetarily and assist distribute wealth past the bigger shareholders.”

Momentum Capital:

Momentum Capital is a worldwide micro-VC agency with a presence in Canada, US & India, and invests in Indian expertise startups on the pre-seed and seed levels in local weather, SaaS, well being, and shopper areas. With a powerful set of advisors, traders, and companions having deep investing expertise unfold throughout continents & verticals, the agency supercharges world community leverage for Indian founders on the earliest levels.

Ankur Shrivastava, Founder & Managing Partner: Momentum Capital

Ankur Shrivastava is a extremely skilled startup investor and is the co-founder of Globevestor, a pioneering cross-border startup funding platform. He led Globevestor’s investments in over 40 startups, together with Zoomcar, Springboard, Agnikul, and others throughout SaaS, tech, well being, local weather, shopper, and different various areas. His previous portfolio corporations have collectively raised about $500 million in capital and are collectively valued at over $2.5 billion now.

Rabindra

India is about to witness a baseline GDP growth of 6.5 p.c as per actual phrases in 2023-24, in accordance to the financial survey for 2022-23, which was laid in Parliament by Finance minister Nirmala Sitharaman on Tuesday.

The survey stated that in actual phrases, the economic system is predicted to develop at 7 p.c in the current monetary 12 months (2022-23), a downward revision from 2021-22, when the growth was 8.7 p.c in the earlier monetary 12 months (2021-22).

The fiscal deficit for 2022-23 is estimated to be 6.4 p.c of the GDP, the doc stated.

“Despite the three shocks of Covid-19, the Russian-Ukraine battle and the central banks throughout economies led by Federal Reserve responding with synchronised coverage fee hikes to curb inflation, main to appreciation of greenback and widening of the current account deficits (CAD) in internet importing economies, companies worldwide proceed to venture India because the fastest-growing main economic system at 6.5-7.0 per cent in 2022-23,” the survey famous.

According to the financial survey, India’s financial growth in 2022-23 has been primarily led by personal consumption and capital formation and these have helped generate employment as seen in the declining city unemployment fee and in the sooner internet registration in worker provident fund.

Moreover, the world’s second-largest vaccination drive involving greater than two billion doses additionally served to carry the patron sentiment which will delay the rebound in consumption. Still, personal capex quickly wants to take up the management position to put job creation on a quick observe, the survey stated additional.

The optimistic growth forecasts have been primarily projected on the premise of a number of constructive elements like rebound of personal consumption which gave a lift to manufacturing actions, larger capital expenditure, near-universal vaccination protection enabling folks to spend on contact-based providers, reminiscent of eating places, motels, procuring malls and cinemas, in addition to the return of migrant staff to cities to work in building websites main to a big decline in housing market stock.

The survey, which highlights the financial efficiency of key sectors throughout the ongoing fiscal, additional famous that strengthening of steadiness sheets of corporates, a well-capitalised public sector banks prepared to enhance the credit score provide and the credit score growth to the micro, small and medium enterprises (MSME), had been a number of the different elements which have boosted optimism for a wholesome growth projection in 2023-24.

Apart from housing, building exercise in common has considerably risen in 2022-23 because the much-enlarged capital funds (capex) of the Central authorities and its public sector enterprises is quickly being deployed, the survey stated, including that if one goes by capex multiplier, the financial output of the nation is about to enhance by not less than 4 occasions the quantity of capex.

“States, in combination, are additionally performing properly with their capex plans. Like the Central authorities, the states even have a bigger capital funds supported by the Centre’s grant-in-aid for capital works and an interest-free mortgage repayable over 50 years,” it famous.

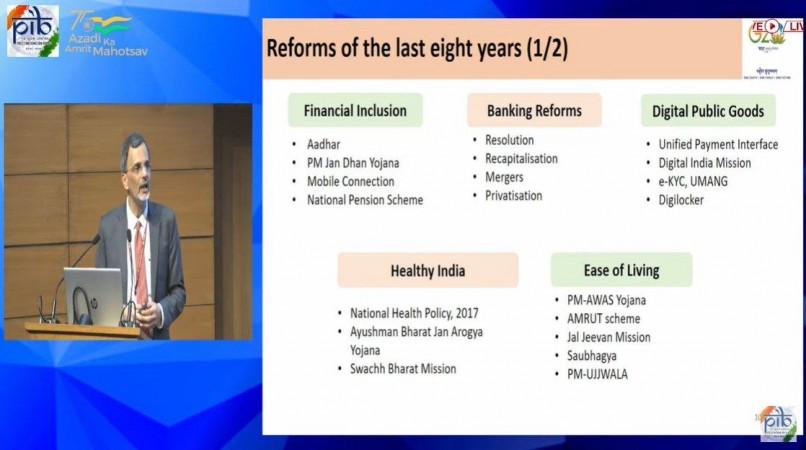

Key highlights of Economic Survey:

Chief Economic Advisor V . Anantha Nageswaran has famous that India’s economic system is poised to do higher in the rest of this decade. Here are the important thing highlights from Chief Economic Advisor’s presentation on Economic Survey:

Recovery of the economic system is full; non-banking and company sectors now have wholesome steadiness sheets, therefore, we do not have to converse of pandemic restoration anymore, we now have to look forward to the following section.

Leverage ratio in the company sector went very sharply in the primary decade of millennium, the second decade was thus a payback time, extreme credit score growth had to be adjusted for in the second decade, steadiness sheets now have been repaired, & credit score growth is selecting up.

Reforms of final eight years spanning a number of dimensions together with digital, social and bodily infrastructure had been taking place at the same time as banking clear up was occurring.

(With company inputs)

HCLTech, a number one world know-how firm, has been named as a Leader in the 2022 Gartner® Magic Quadrant™ for Managed Network Services. This is the second 12 months in a row that HCLTech has obtained this recognition.

HCLTech is among the many main suppliers of managed broad space community (WAN) and native space community (LAN) companies globally with well-defined service descriptions, operational processes and standardized service supply for enterprise clients. A overwhelming majority of HCLTech’s shopper websites are situated in Europe and the Americas.

“Network is the unifying digital cloth that empowers enterprises to speed up their digital journeys, strengthen aggressive differentiation and future-proof their enterprise. We consider that this recognition serves as a validation of our investments throughout multi-edge applied sciences—SD-WAN, personal 5G and edge computing, data technology-operational know-how convergence and community automation, whereas serving to our clients unlock worth all through the engagement,” mentioned JagadeshwarGattu, President, Digital Foundation Services, HCLTech.“We consider our recognition is a testomony of our imaginative and prescient, technique, buyer success and maturity in the next-generation community (NGN) enterprise.”

HCLTech’s service supply platform (SDP), with differentiated capabilities in data technology-operational know-how convergence, makes it a definite community participant throughout business verticals. The firm’s feature-rich portal for account administration, SLA administration, efficiency reporting and co-management of each LAN and WAN differentiates it from its friends.

Additionally, the corporate’s in depth assist for multi-cloud finish customers—mixed with versatile business fashions—has accelerated its journey in the direction of turning into a real Network Services Orchestrator (NSO).

To learn extra concerning the report, go to https://www.hcltech.com/analyst/analyst-reports/hcltech-positionedleader-2022-gartnerr-magic-quadranttm-managed-network

Disclaimer: Gartner, Magic Quadrant for Managed Network Services, Ted Corbett, Et Al., 5 December 2022.

Gartner doesn’t endorse any vendor, services or products depicted in its analysis publications, and doesn’t advise know-how customers to pick solely these distributors with the very best scores or different designation. Gartner analysis publications include the opinions of Gartner’s analysis group and shouldn’t be construed as statements of truth. Gartner disclaims all warranties, expressed or implied, with respect to this analysis, together with any warranties of merchantability or health for a selected function.

GARTNER is a registered trademark and repair mark of Gartner, Inc. and/or its associates in the U.S. and internationally, and MAGIC QUADRANT is a registered trademark of Gartner, Inc. and/or its associates and are used herein with permission. All rights reserved.

Neel Achary

Quantamental investing is a hybrid funding technique that mixes using quantitative evaluation and elementary evaluation. Quantitative evaluation is a technique of investing that makes use of mathematical fashions and algorithms to research and make funding selections, whereas elementary evaluation is a technique of investing that entails finding out an organization’s monetary and financial fundamentals with the intention to decide its intrinsic worth.

Quantamental investing entails utilizing quantitative instruments and methods to establish potential funding alternatives, after which utilizing elementary evaluation to verify or disprove the validity of these alternatives. This method will help to cut back the potential for human bias and emotional decision-making within the funding course of, in addition to offering a extra complete and holistic view of potential investments.

Generally talking there are three main cases the place we see quantamental methods employed. The under summarizes every and begins with the implementation technique that’s typically probably the most profitable – issue based mostly investing.

One of the important thing benefits of factor-based quantamental investing is that it might assist to establish undervalued securities that could be missed by conventional elementary evaluation. Quantitative instruments and methods can be utilized to research massive quantities of knowledge and establish components which will assist analysts concentrate on shares which have empirical options that give them an intrinsic statistical benefit. This can result in the identification of potential funding alternatives that may in any other case be missed.

We talked about earlier that issue based mostly investing typically concerned using components like worth, momentum and dimension. These components are properly understood and infrequently thought-about fundamental constructing blocks of factor-based quantamental methods. Yet to counsel these are the unique areas the place components can be utilized could be to understate the case for any such quantmental investing.

An incredible instance of that is Kailash Concepts. Founded by a profitable former cash supervisor from Fidelity Investments and a number one educational at Cornell University within the subject of behavioral finance, the agency excels in utilizing quite a few components of their quantamental investment process. Reading their materials exhibits the breadth and depth of things that may be employed, starting from the integrity of a inventory’s accounting to a agency’s track-record of capital allocation.

Another benefit of quantamental investing is that it might assist to cut back the influence of market volatility on funding selections. Quantitative instruments and methods can be utilized to research market information permitting traders to take a extra proactive method to managing threat. Quantamental investing can primarily achieves this by serving to to optimize portfolio building. By permitting human judgement to be current whereas eradicating the tendency for portfolio managers and analysts’ feelings from impacting the sizing of funding bets, it might forestall portfolios from reflecting human biases.

While quantamental investing methods have the potential to supply vital benefits over conventional funding approaches, there are additionally a number of potential disadvantages to pay attention to.

In conclusion, whereas quantamental investing methods can provide vital benefits over conventional funding approaches, there are additionally a number of potential disadvantages to pay attention to. These embrace information dependence, lack of flexibility, backtesting bias, lack of human perception and restricted utility. It is necessary for traders to fastidiously think about these components earlier than deciding to undertake a quantamental investing technique and to make use of them together with different funding methods.

Neel Achary