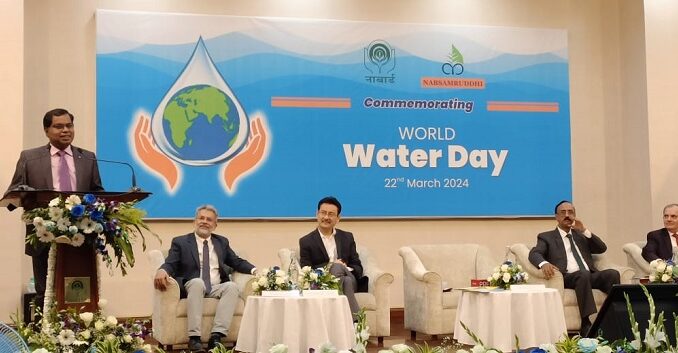

Left to right G.S. Rawat_ Shaji K.V._ Satish B. Rao_ A.K. Sood

MUMBAI: NABARD commemorated its 43rd Foundation Day with a grand celebration at its Headquarters in Mumbai. The occasion was honored by eminent guests, stakeholders, and well-wishers who have played a critical role in NABARD’s developmental journey.

The highlight of the celebration was a Panel Discussion on “Climate Risk Management and Banking.” The panel featured esteemed experts including Dr. Trupti Mishra, Professor at IIT Bombay, Shri Santosh Kumar Singh, MD of Intellecap, and Dr. Sat Singh Tomer, CEO of Satyukt (Start-up). The discussion was adeptly moderated by Shri Vivek Adhia from BCG. In addition, several significant publications were released, and a short film was launched to mark the occasion.

Laying out a brief timeline of the organization, NABARD Chairman Shri Shaji K. V. discussed NABARD’s journey over the past 4 decades. He said, “Over the past four decades, NABARD has been a cornerstone of rural development in India. From pioneering the SHG-Bank Linkage Program to supporting JLGs and FPOs, our initiatives have empowered millions of rural households and farmers. Our interventions have fostered financial inclusion, enhanced productivity, and driven sustainable development. Embracing digital transformation, we are helping GOI in computerizing 65,000 PACS and integrated Core Banking Solutions in numerous rural cooperative banks. As we continue to innovate and adapt, our mission remains the same: to uplift the rural economy, ensuring prosperity and resilience for all rural communities.”

Mr G.S. Rawat, DMD of NABARD, emphasized on the need to address the issues related to the agri and rural sectors of the country. “Despite the geographical and infrastructural limitations, our country is among the top 5 producers of agri-commodity in the world. There is still a credit gap in the northeastern regions of the country that needs to be addressed. NABARD is dedicated to working towards finding solutions to the challenges and bridging the gap by leveraging technology. We need innovations to ensure the credit flow to small farmers from remote areas of the country. Innovation will be a catalyst in enhancing the efficiency of the existing agri value chain”

Highlighting NABARD’s key role in the development and prosperity of rural India, Dr. A.K. Sood, DMD of NABARD, said, “Nothing delivers results like success, and we have consistently increased our credit flow to agriculture, delivering impactful results and touching the lives of millions of farmers over two-and-a-half decades. We are also embracing technology to explore new frontiers in financial inclusion, leveraging fintech for underserved rural India. Our challenges now are new—climate change, water scarcity, and an unceasing spiral of indebtedness among farmers. But shoulder-to-shoulder with all stakeholders, we will continue to strive to build a more inclusive and resilient rural India.“

Concluding the event, Shri Shaji K.V. reiterated the pivotal NABARD has to play in realizing the dream of ‘Vikasit Bharat’ by 2047. “We are also looking forward to strengthening the other sectors like fisheries and we believe that our initiatives will help in the growth of rural GDP to support the growth of our country. NABARD has an important role to play in strengthening the foundation of the vision of ‘Vikasit Bharat’ by 2047”.

The 43rd Foundation Day celebration of NABARD was a resounding success, reflecting its enduring legacy and future aspirations.

Mumbai, 19 December 2023: National Bank for Agriculture and Rural Development (NABARD) and Asian Development Bank (ADB), launched an initiative to facilitate local weather motion in India’s agriculture, pure sources, and rural improvement (ANR) sector. Under this initiative, a Technical Support Unit (TSU) has been arrange in NABARD with the partnership of Bill and Melinda Gates Foundation (BMGF) to allow NABARD to handle the challenges posed by local weather change, significantly in the areas of agriculture and rural livelihood sectors in India.

Mumbai, 19 December 2023: National Bank for Agriculture and Rural Development (NABARD) and Asian Development Bank (ADB), launched an initiative to facilitate local weather motion in India’s agriculture, pure sources, and rural improvement (ANR) sector. Under this initiative, a Technical Support Unit (TSU) has been arrange in NABARD with the partnership of Bill and Melinda Gates Foundation (BMGF) to allow NABARD to handle the challenges posed by local weather change, significantly in the areas of agriculture and rural livelihood sectors in India. Mumbai, ninth September 2023: The National Bank for Agriculture and

Mumbai, ninth September 2023: The National Bank for Agriculture and